Requirements: Legal business name and address.Perks: Identity theft & Lost wallet protection.

DIVVY CREDIT BUILDER FREE

If you just need a range rather than an exact score, you still get credit summaries (A to F) from all but TransUnion by downgrading to a Free Plan once you get the business credit cards or loans you desire.

This way you can quickly review your business credit scores from Dun & Bradstreet, Experian Business, and Equifax Business, along with your personal credit scores from TransUnion and Experian. So, it’s only worth signing up for a month here or there. Unfortunately, the $30/mo Business Manager Plan, does not come with tradeline reporting. Nav was one of a few vendors on our list of net 30 accounts for new business in 2021 that stuck in the Top 5 all year, and they are trending to repeat this act in 2023. With their $40 per month, Business Boost Plan you’ll get access to tradeline reporting, which includes a credit reporting boost of your Nav Membership monthly payment.

DIVVY CREDIT BUILDER FULL

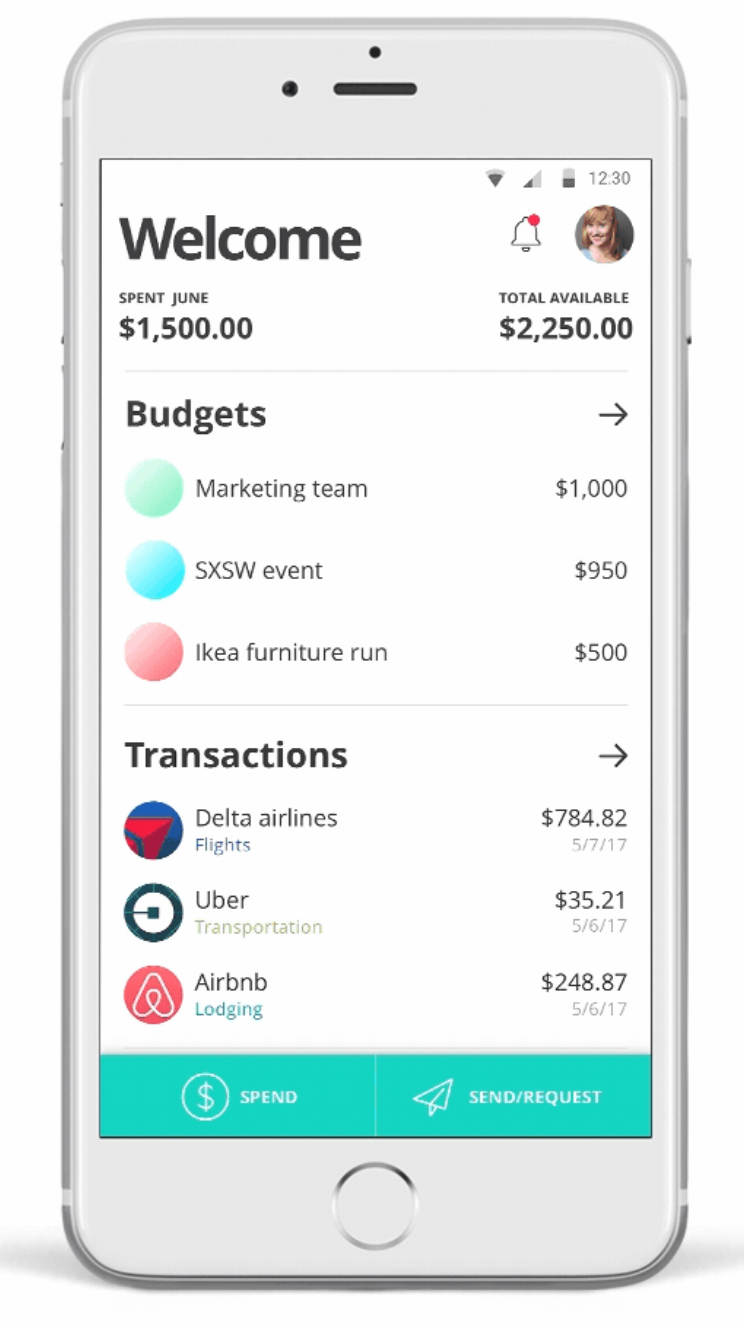

Don’t wait until your invoice is due, as each one you pay in full will increase your reported credit limit. The key to building business credit with Ohana Office Products is to only make minimum purchases of $80, and then pay your bills as soon as possible. For each additional order of $80 you place on your credit line, you will receive a credit limit increase of $1,000. Initially, you will receive a $2,000 credit line reported on your tradeline on your first order of at least $80 or more. Ohana topped our net 30 vendors list in 2021, but others have had months where they leapfrogged them in 20. This makes them a perfect starter vendor as the only cost to get credit approval and tradeline reporting are the purchases you make. While other office supply vendors make you pay $75-$100 a year to get credit reporting on your tradeline, vendor membership at Ohana has no annual fee. In the meantime, if you want tradeline reporting across every major business credit bureau, check out these popular office supply companies. Unless a sales rep approaches you, you’ll generally need 1-2 years of consistent revenues to get approval or a personal guarantee to get these Tier 2 net 30 vendors. Get Divvy Office Suppliesįor those hoping that Staples and Office Depot NET 30 accounts are easy to get, unfortunately, they’re not. No personal guarantee is required! All cardholders can also earn up to 7x reward points on hotels and 5x on restaurant purchases. Small business owners that can prove steady monthly revenues can apply for a Divvy corporate visa card.

Extra points are also awarded to suppliers who regularly report to the top commercial credit bureaus of Dun & Bradstreet, Experian, and Equifax.ĭivvy credit limits are determined by spending ability, not credit scores. Ranking preference is given to net 30 vendors who offer new and established businesses credit accounts and tradelines with fast and easy-approval requirements. Our June 2023 updated list of net 30 business accounts is dominated by companies that report to multiple major business credit bureaus.

0 kommentar(er)

0 kommentar(er)